PRESS RELEASE: January 14th, 2020

CONTACT: Stanley Crawford / BMCCP (215) 275-4015 stanleycrawford6@gmail.com

THE BLACK MALE COMMUNITY COUNCIL OF PHILADELPHIA ANNOUNCES MAJOR AFRICAN AMERICAN ECONOMIC IMPACT TO PHILADELPHIA

“THE BLACK FOLKS PLAN FOR PHILADELPHIA” A MULTI-BIILION DOLLAR GRASSROOTS INITIATIVE

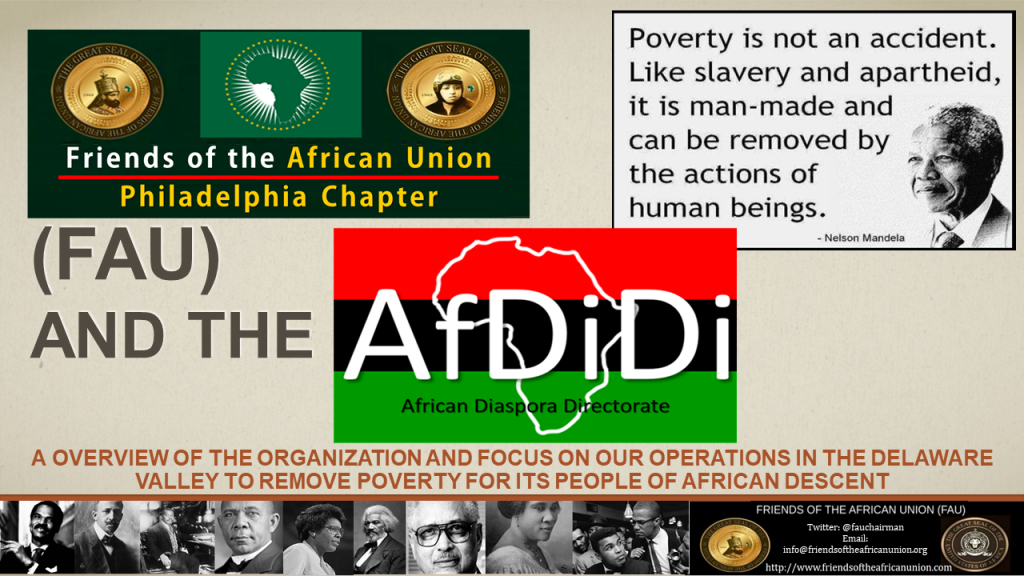

On Thursday January 16, 2020 at 12:00 Noon EST at the Guardian Civic League, 1516 W. Girard Ave. The Black Male Community Council of Philadelphia (BMCCP) in conjunction with The Friends of the African Union (FAU) and the African Diaspora Directorate (@AfDiDi2063) will announce “The Black Folks Plan for Philadelphia” a Multi-Billion grassroots initiative that will have a direct impact on Real Estate, development, Employment, Human Service, and Culture in the City of Philadelphia.

The Black Male Community Counsel of Philadelphia (BMCCP) was selected by the FAU to organize African American grassroot non-profits and for-profits projects to be founding members of what is now “The Philadelphia smartWISE Project Coalition”, a co-sponsor of The Black Folks Plan for Philadelphia which is be known online as the #BlackFolksPlanfoPhiladelphia. BMCCP has gained a track record of Boots on the Ground, All Hands on Deck efforts for the betterment and upliftment of the Black Community. It is now joined in these efforts by FAU and the African Diaspora Directorate.

The African Diaspora Directorate (www.AfricanDiasporaDirectorate.org), a member of the National Community Reinvestment Coalition (NCRC), along with Friends of the African Union, will use the newly approved on Dec 7th 2019 $60B Truist Bank Community Benefit Agreement “CBA” to focus, through The Black Folks Plan for Philadelphia, on the needs of Black Folk and allies in Philadelphia. Together we will create within The Black Folks Plan for Philadelphia a plan of action to mobilize this CBA in 2020.

The largest to date NCRC led CBA is a three-year $60 billion agreement for the region served by Truist Financial Corporation, which includes Philadelphia. The combined company to be created through the merger started operations with over $450B in assets and is the 6th largest bank in the USA. Truist committed $31 billion towards specific home purchase lending to people of color and LMI Communities. It dedicated $7.8 billion in lending to small businesses with annual revenue of less than $1 million, $17.2 billion to Community Development loans and $3.48 billion to Community Development Investments.

Truist also pledged $120 million for CRA-qualified grants. In addition to the monetary obligations of the agreement, Truist pledged to open 15 new branches in LMI Neighborhoods and Communities of color and to create a Signature Capacity Building program with a focus on Racial Equity and Economic Mobility. Truist will to strive to spend 10% of their third-party vendor spending on diverse suppliers. Lastly, Truist committed to creating a Community Advisory Board in collaboration with NCRC.

“Banks have an important role to play in our Communities, and these Community Benefits Agreements help ensure they fulfill that role for everyone, including low- and moderate-income Communities and Communities of Color,” said John Taylor, President and CEO of the National Community Reinvestment Coalition (NCRC), the driving force behind the recent proliferation of bank CBAs.

Since 2016, NCRC has facilitated the creation of CBAs worth nearly $150 billion with these Banking Groups: KeyBank in March 2016 for $16.5 billion; Huntington Bancshares in May 2016 for $16.1 billion; Fifth Third Bank in November 2016 for $30 billion; First Financial Bank in October 2017 for $1.7 billion; Santander Bank in November 2017 for $11 billion; IBERIABANK in November 2017 for $6.7 billion; First Tennessee Bank in April 2018 for $4 billion; Wells Fargo & Company (DC) in October 2018 for $1.6 billion; Fifth Third updated agreement in October 2018 for an additional $2 billion; and, the latest with BB&T and Suntrust in July 2019 for $60 billion.

Our operations in Philadelphia including The Philadelphia smartWISE Project Coalition and FAU Philadelphia will be joining NCRC this year. Together we plan to leverage the Trusit CBA to benefit the people of Philadelphia through the creation of the Friends of the African Union smartWISE Community Reinvestment Coalition of greater Philadelphia to reach out beyond just the 600,000 black folk in the city. The FAU smartWISE Community Reinvestment Coalition Model will use technology and branding labeled smartWISE, which is inclusive of “wisdom based” or “Wise” models. The FAU smartWISE business model is meant to collect unfathomable amounts of data through FAU Philadelphia Chapter memberships, but also do so at the speed of digital Cloud. Then, and very importantly, data can then be mined to allow the next step of decisions and action based on this “Wise” technology. FAU smartWISE is based on a vision, in Philadelphia, of the future that believes that the exponential growth of hardware and a secure “Internet of Things” that can surpass the non-exponential growth capabilities of the human mind. This then will be incorporated into the Black Folks Plan for Philadelphia.

We do this work using the Cross-Cutting Topics Covered in the FAU smartWISE Community Reinvestment Coalition model that works with the African Diaspora Directorate to create representation for People of African Descent in Pennsylvania, in the United Nations, in the African Union and other international forums. A example of this is creating the FAU Pennsylvania Assembly Black Family Reunion:

###